LP Intelligence Hub

Capital insights for LPs who value execution over theory.

No Fluff.

Every PUCP white paper is built for institutional LPs — no filler, no hype, just the frameworks and data that actually move capital.

Actionable.

Each piece translates directly into execution — from due diligence to deployment, we turn analysis into operator playbooks LPs can use.

Conviction.

We publish ahead of the market — distilling insights from live deals and GTM trenches before they hit mainstream VC thinking.

Execution Capital in Action — Frameworks That Move Money.

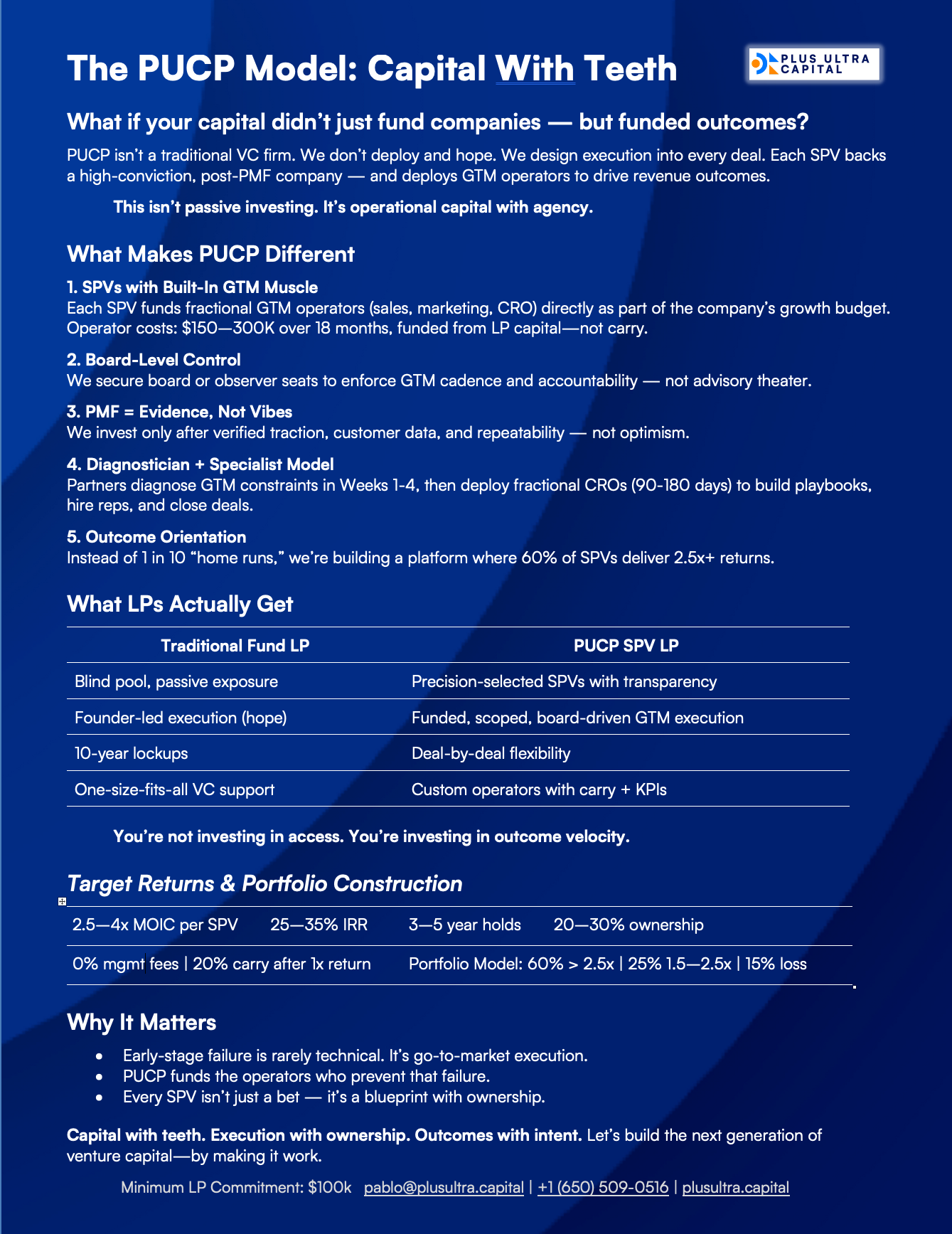

PUCP

One–Pager.

-

Our Mission

-

The Difference

-

What LPs Get

-

Target Returns & Portfolio Construction

-

Why it Matters

Manufacturing

Alpha.

- Executive edition (Thesis)

- The Execution Gap

- Why tradition VC can't fix it

- Mispricing Arbitrage

- The PUCP Model

- Target Returns

Protecting LP Capital.

- Proprietary Framework

- Revenue Diligence

- Baseline Forecast Lock-in

- Revenue Command Assessment

- Forecast Stability Test

Diligence Matters.

- PMF Evaluation Engine

- Quantifying PMF

- Why PMF Fails

- Measuring PMF Durability

- Case Study

- Why it matters